Ah, another accounting acronym. What a treat! Shall we add EBITDA to the pile of financial frameworks that don’t really make sense?

Actually, hold fire.

We know that navigating the world of accounting can be overwhelming, especially as a restaurant owner, so we’ve simplified it! Keep reading for a simple, no-nonsense breakdown of EBITDA, including three ways you can improve it in your restaurant.

Before we get to that, let’s clarify what EBITDA means. No need to thank us, you’re welcome. 😎

What is restaurant EBITDA?

EBITDA is an acronym for earnings before interest, taxes, depreciation, and amortisation. It’s designed to help business owners put a firm value on their earning power by focusing on cash flow.

It removes items from earnings that business managers have some discretion over, like debt financing or capital expenditure. As a result, you can visualise your financial performance without taking your capital structure into account.

Fun fact 🤪 EBITDA is pronounced eh-bit-dah — it’s a funky word to say out loud, that’s for sure.

How to calculate EBITDA for your restaurant

Here’s how to calculate EBITDA:

Net income + interest + taxes + depreciation + amortisation = EBITDA

All of this information is usually found at the bottom of your income statement, although you may have to go to your cashless statement to find your depreciation and amortisation costs

A quicker format for calculating EBITDA is to take your operating income, and add depreciation and amortisation:

Operating income (EBIT) + depreciation + amortisation = EBITDA

What is adjusted EBITDA?

Adjusted EBITDA removes any one-time, irregular, and non-recurring payments. For example, upgrading your POS system is a one-time thing (or at least not regular), so it’s not included in the adjusted EBITDA calculation.

This makes the calculation more accurate, painting a clearer picture of your financial performance.

Are there any downsides to using EBITDA?

Although there are benefits to using EBITDA in hospitality, it’s important to note that there are some downsides, too:

- It can create a false sense of profitability. It presents the company as if you never pay taxes, interest, or capital expenditures. This can create a false image of your financial performance and profitability, which can result in poor decisions and smaller financial growth.

- It doesn’t take depreciation into account. It shows assets as though they never lose value over time, which isn’t the case. If you’re using EBITDA to help with forecasting future performance, this can be a problem.

- It’s not formally recognised. The framework isn’t recognised under the generally accepted accounting principles (GAAP).

Why use restaurant EBITDA vs restaurant operating profit

Before we compare EBITDA with operating profit, let’s clarify what operating profit actually is:

Operating profit is all the money you have left after paying all your business costs, but before paying tax. It shows that your restaurant can generate more money than you’re spending — but remember, you still have taxes to pay before calculating your net profit.

Now, let’s walk through some of the reasons you might use EBITDA over your restaurant operating profit:

- To understand your potential capacity to generate profit. EBITDA shows your restaurant’s broader capacity to generate profits, which can be helpful for predicting future financial performance.

- To secure financial investment. By removing things like debt financing and operating income, EBITDA helps an investor see past any issues with management manipulation. It allows them to analyse potential earnings based on the production efficiency of your core restaurant operation.

- To remove depreciating assets from your financial analysis. EBITDA doesn’t take depreciation expenses into account because they don’t correspond with real cash outflows. In doing so, you get a more accurate representation of your restaurant’s financial health. There are also multiple ways to calculate depreciation, so leaving this figure out can improve accuracy.

How to improve restaurant EBITDA

The first element of the EBITDA formula is your net income. So, it only makes sense that increasing your net income will improve your restaurant EBITDA!

The good news is there are lots of ways to boost your net income. Here are some of the top hitters:

- Optimise your menu. Identify your top-selling and most profitable items to try and increase revenue. With a platform like Nory, you can easily spot these items and create a menu that boosts your profit margins (and hopefully, your net income).

- Minimise food costs. Reduce your spending on food and ingredients by negotiating prices with existing suppliers. Consider bulk orders, paying in advance, or signing a longer contract. If you can’t negotiate with current suppliers, why not source new ones?

- Create personalised promotions. Encourage diners to spend more at your restaurant by providing personalised promotions and discounts. For example, let’s say you offer a digital loyalty programme. Using the data from past purchases, you can make unique offers that appeal to each individual diner.

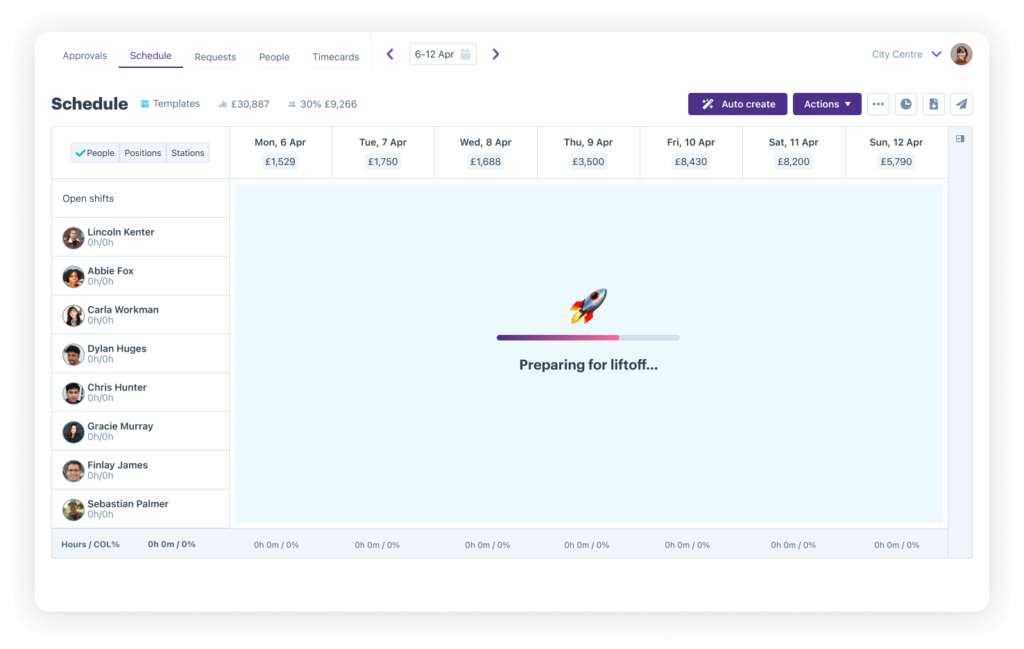

- Optimise labour scheduling. Spend less money on wages by creating demand-based schedules with an AI-powered system. Nory analyses historical data to predict demand, preventing overstaffing and helping you save money on labour costs.

Nory success story 🚨 Find out how Roasting Plant cut labour costs by 18% in just two months of working with Nory. With accurate sales forecasting, the cafe was able to improve its scheduling to meet customer demand and keep labour costs down.

“It’s been an absolute dream working with Nory. The support we get is incredible, which helps us get the most out of the product.”

Kallie Kocourek, Vice President of the UK Market

Work with Nory to elevate your bottom line

EBITDA is just one way to analyse your financial performance and predict future profits. It has its drawbacks, sure — but as long as you’re aware of them and why you’re using EBITDA, it can be a useful metric.

If you’re thinking about ways to improve your EBITDA and grow your profits, consider using Nory.

Our restaurant management software provides you with all the features you need to improve your financial performance. Track sales in real-time, monitor productivity, manage your inventory, review costs — we don’t want to brag, but the list goes on!

But don’t just take our word for it — take a look at how Dr. Juice increased sales per labour hour by 43% from using Nory.

FAQs

What is the average EBITDA for a restaurant?

According to data from NYU, the industry benchmark is 18.37%. Typically speaking, an EBITDA margin of between 10-20% is ideal (although ideal figures will vary depending on your specific restaurant.

Is EBITDA the same as gross profit?

No, it’s not. Gross profit is the money you make after subtracting any costs associated with making and selling your food and drink (also known as the cost of goods sold). For example, cost of ingredients, production, and packaging.

Is EBITDA a bad metric?

It’s not a bad metric, so long as you’re aware of the drawbacks when using it. It’s useful for figuring out your potential profit, but it doesn’t paint a totally accurate picture of your financial performance.