Making sure restaurant managers feel comfortable with profit and loss (P&L) statements is one of the best ways to increase your profits.

Think about it. If they’re not confident in their understanding of P&L, how can they improve it?

They need to know exactly how it works, line by line, to make it better. And when they make improvements to the P&L, your bottom line improves. It’s as simple as that.

In this article, we’ll walk you through how to support your restaurant managers with their understanding of P&L.

3 ways to give restaurant managers confidence with their profit and loss statement (P&L)

Let’s take a look at some of the ways you can help restaurant managers take control of their P&L and improve the bottom line of your business.

1. Ensure they understand every aspect of a P&L statement

Start by training restaurant managers on the ins and outs of P&L reporting. This will give them the confidence to know how it works and how it translates into the day-to-day operations of the restaurant. Then, they can identify opportunities to improve the P&L.

For example, let’s say you’ve explained the P&L statement to your restaurant manager. They can now see and understand the direct impact of the costs of goods sold (COGS) on your gross profit (GP). As a result, they can actively identify ways to reduce COGS, raise your GP, and increase your net profit.

Top tip 💡If you’re concerned that a full P&L breakdown might be overwhelming for managers (because let’s face it, they can be pretty detailed), focus on flash P&L reports instead. These reports prioritise the most critical financial metrics (such as total revenue, COGS, overheads, GP, and net income), avoiding the figures that might not be necessary for restaurant managers to understand.

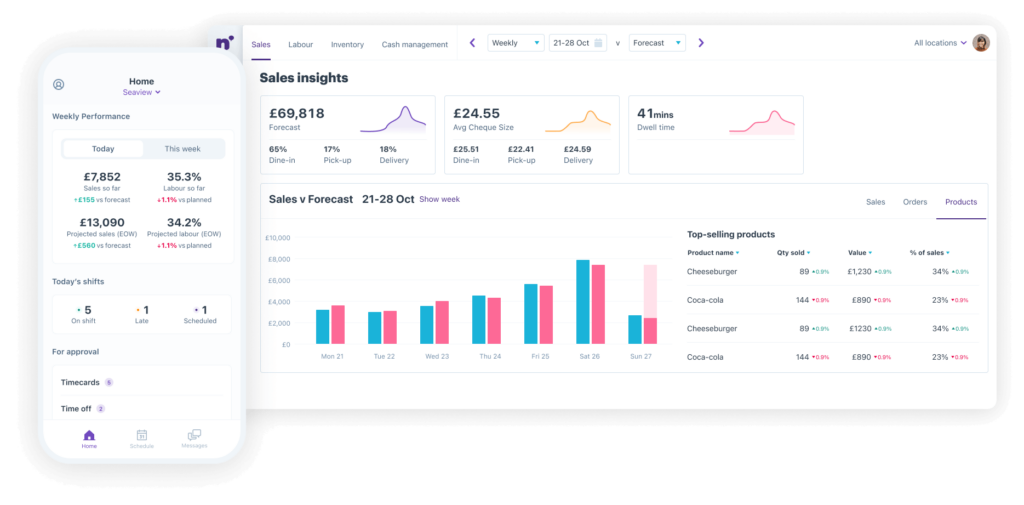

And to make it even more manageable, use a platform like Nory to manage all your P&L reporting!

With our restaurant management system, managers can see real-time P&L data, line by line. They don’t need to wait until next month to see accurate performance, so they can make quick and informed decisions about how to improve the bottom line.

2. Discuss cost control strategies

Work with restaurant managers to pinpoint different avenues of cost control. These strategies can encourage them to take control of their P&L, feeling confident that they can improve the bottom line and increase profit margins.

Here are some of the cost-control measures you could discuss:

- Negotiating with suppliers. Bring supplier costs down by negotiating existing partnerships. Consider bulk options, long-term deals, or swapping ingredients for lower-cost alternatives.

- Minimising waste. Reducing food waste is a great way to control costs by only ordering ingredients you actually need. Plus, there’s the added bonus of being better for the environment, too.

- Identifying opportunities for operational efficiencies. Review your operations and processes to find areas of improvement. This could be anything from the customer ordering process to your kitchen structure. Any processes that can be improved to impact the bottom line are worth investigating.

3. Set goals and clear expectations

If you want to be more specific than outlining general cost-reduction strategies, you can set goals. This sets clear expectations for restaurant managers when it comes to financial performance. They know exactly what they’re working towards, so they’re better equipped to make the right adjustments.

Let’s use an example.

You set a goal to decrease labour costs by 10% over the next quarter. With this in mind, your restaurant manager can analyse the P&L statement to identify current labour costs, work out what the ideal costs should be, and find ways to minimise them.

It provides them with certainty, knowing they’re using the P&L statement to achieve a specific goal.

Make P&L reporting a breeze with Nory

Nory’s restaurant management software provides restaurant managers with live P&L grade reporting. They can access real-time sales data, without waiting until the following month to analyse performance.

It gives them confidence in their decisions, allowing them to see the direct impact of their choices. Plus, they can closely monitor performance to ensure things are heading in the right direction.

FAQs about P&L reporting in hospitality

What is P&L in the restaurant industry?

A profit and loss statement (also known as an income statement) is a financial statement that summarises your financial performance throughout a specific time period.

What is the purpose of the P&L report?

Analysing a P&L report shows you how profitable you are, giving you oversight of all your outgoing costs, profit margins, and more. It also helps you identify areas of improvement to increase profitability. You can make adjustments to menu pricing and operational processes to boost profit margins and improve the financial health of your restaurant.

What is the structure of a restaurant P&L?

It varies. At the bare minimum, a P&L statement starts with your total revenue, followed by the cost of goods sold (COGS). Subtracting the COGS from your total revenue leads us to your gross profit (GP). Then, the statement outlines your overhead costs, which you can subtract from your GP to calculate your net profit (your earnings after subtracting all outgoing costs).

A statement that covers these figures (and nothing else) is called a flash P&L statement. A full P&L can include more financial data, such as taxes, interest, expenses, insurance, depreciation, and so on.

Why is the P&L statement important for a hospitality manager to understand?

When restaurant managers understand their P&L, they can assess whether the business is operating at a profit or loss. If it’s operating at a loss, managers can make changes and put measures in place to increase profits and help the restaurant thrive. It also helps them manage costs, track expenses, analyse supplier costs, and improve budgeting.

How can technology help restaurant managers with P&L analysis?

Restaurant technology (like Nory) provides real-time sales performance data, giving restaurant managers instant access to their P&L performance. It predicts demand, assists in inventory management, and optimises workforce scheduling, leading to more informed decisions about how to improve the bottom line.